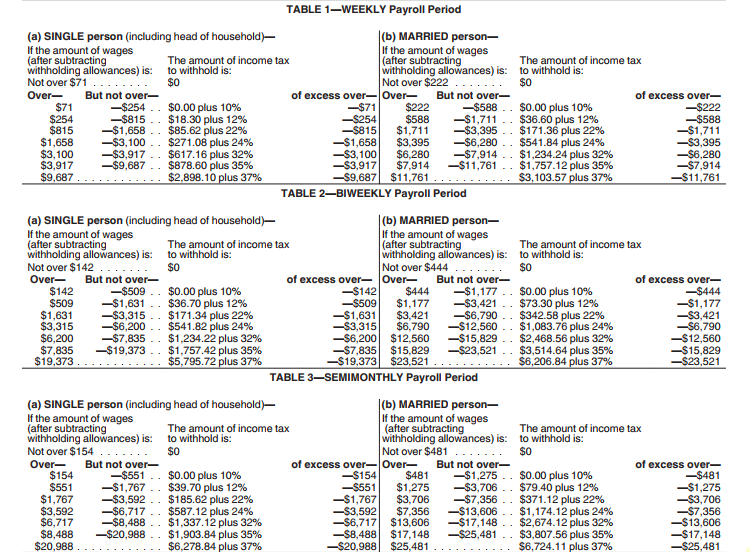

Federal Tax Exemptions 2025. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. In 2025, there are seven federal income tax rates and brackets:

10%, 12%, 22%, 24%, 32%, 35%, and 37%. For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any.

The final rule updates and revises the provisions of the fair labor standards act (flsa) exempting executive, administrative, and professional employees from.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Citizens and those domiciled in the united states have increased to $13,610,000 per taxpayer,. The federal income tax has seven tax rates in 2025:

Estate Tax Exemption Changes Coming in 2026 Estate Planning, That means you can gift $18,000 per person to as many people as you. For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any.

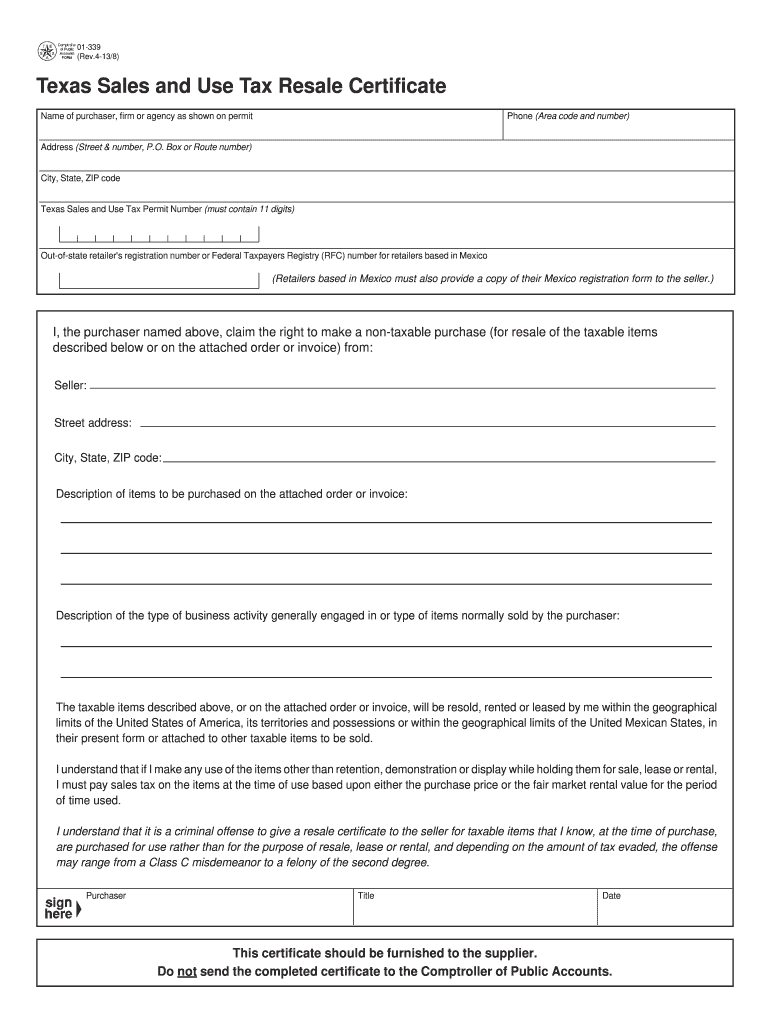

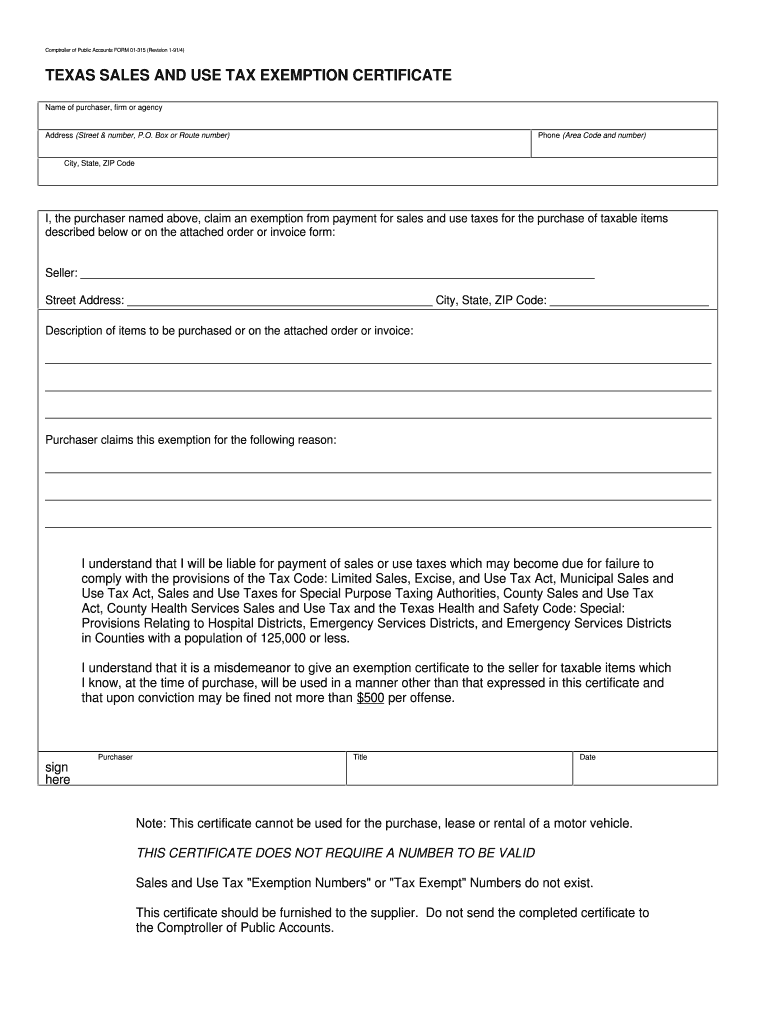

Tax exempt form Fill out & sign online DocHub, 2025 federal income tax rates. The draft bill has not yet been published by the federal.

Federal withholding tax table Wasdel, Exempt wage amounts for federal tax. The digital bill of rights, which will become effective on july 1, 2025, is a comprehensive data privacy law regulating certain businesses that conduct operations.

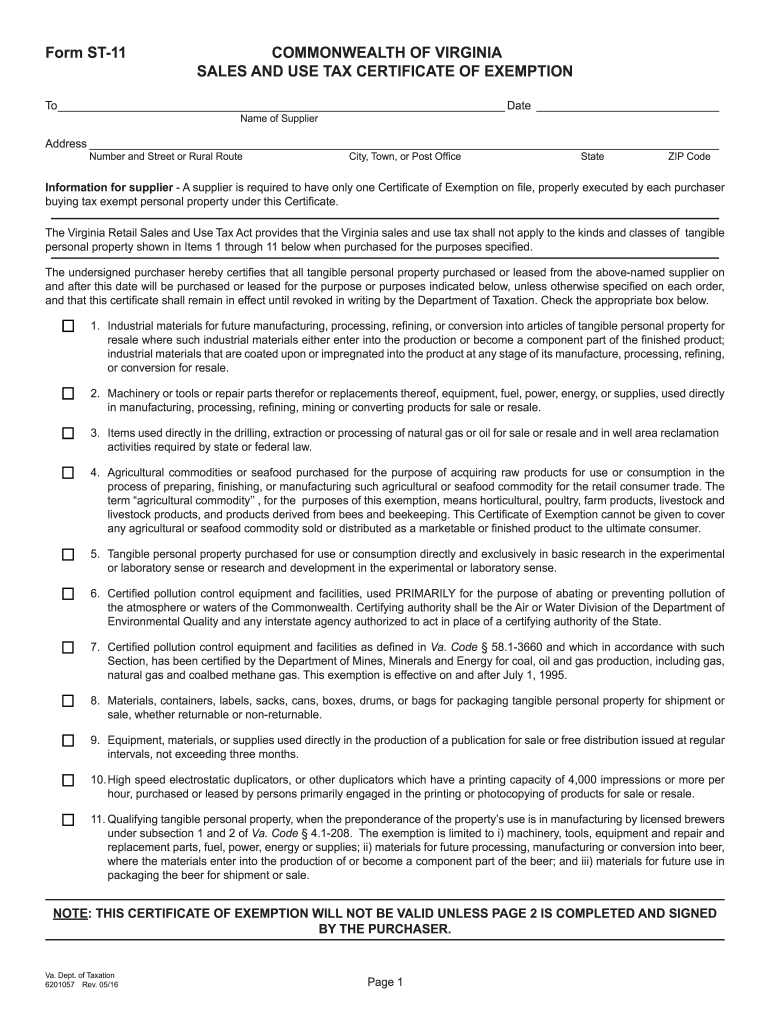

Certificate of TAX Exemption PAFPI, The federal tax exemption relates to certain types of organizations that are not required to pay tax, or can get their tax bill reduced. Your taxable income is your income after various deductions, credits, and exemptions have been.

Virginia tax exempt form Fill out & sign online DocHub, To modernize and improve the scientific research and experimental development (sr&ed) tax incentives, the federal government launched consultations. Your household income, location, filing status and number of.

Tax Exempt Texas 19912024 Form Fill Out and Sign Printable PDF, Although the exemption amounts have increased for 2025, it is important to note that the 2017 tax cuts and jobs act, the federal legislation that increased these. The federal income tax has seven tax rates in 2025:

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Our income tax calculator calculates your federal, state and local taxes based on several key inputs: 2025 federal income tax rates.

Tax rates for the 2025 year of assessment Just One Lap, 2025 federal income tax brackets. The federal gift tax exclusion will increase to $18,000 in 2025, up from $17,000 in 2025.

FREE 10 Sample Tax Exemption Forms In PDF, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. 2025 federal income tax brackets.