Max Sep Ira Contribution 2025 Self Employed Over 50. Sep ira contribution limits are higher than most options, which a max contribution limit. The sep ira contribution limit is directly tied to an individual’s income, permitting contributions of up to 25% of each employee’s compensation or a specified cap,.

These contribution limits reflect the 2025. It’s important to pay attention to sep ira contribution limits.

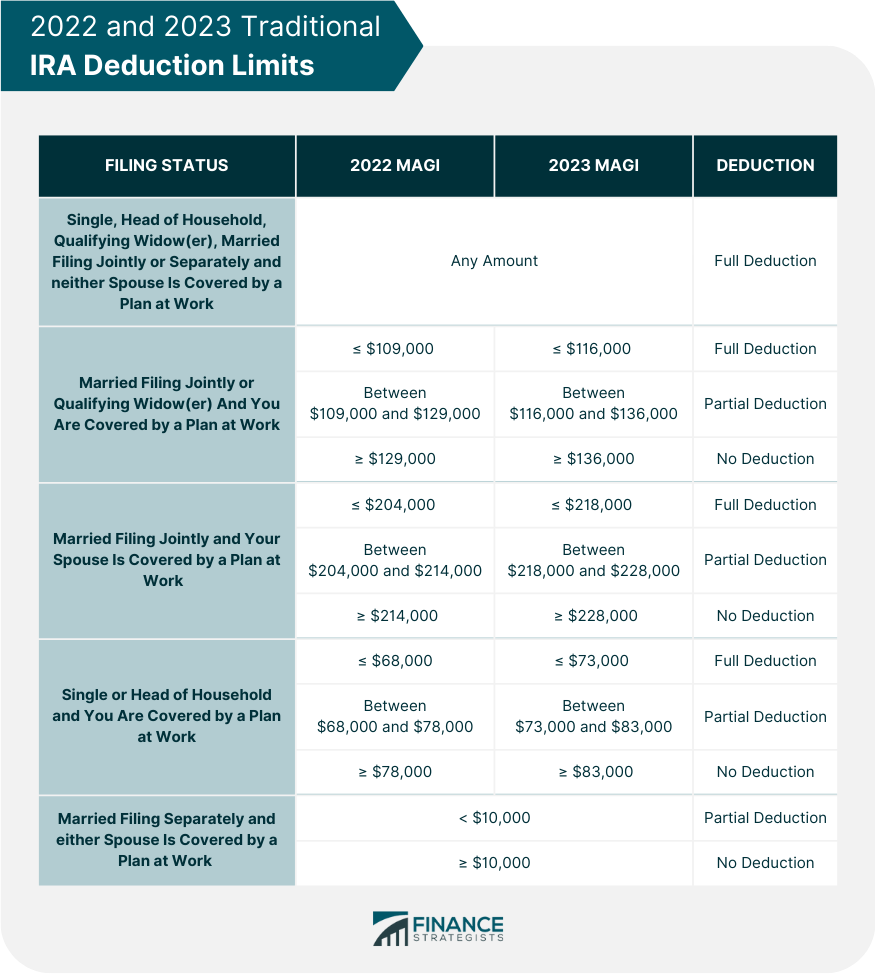

Ira contribution amounts can be reduced or phased out at higher income levels, while solo 401(k)s and sep iras allow larger contributions based on a.

Max Simple Ira Contribution 2025 Over 50 Rowe Rebeka, The combined annual contribution limit in 2025 for a traditional and roth ira is $7,000 for those younger than age 50 and $8,000 for those 50 and older (since the latter are. Or $8,000 if you're over age 50, for tax year 2025—so long as your total.

2025 Ira Contribution Limits Over 50 Emelia, Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older). We’ll also make sure you understand how seps work and.

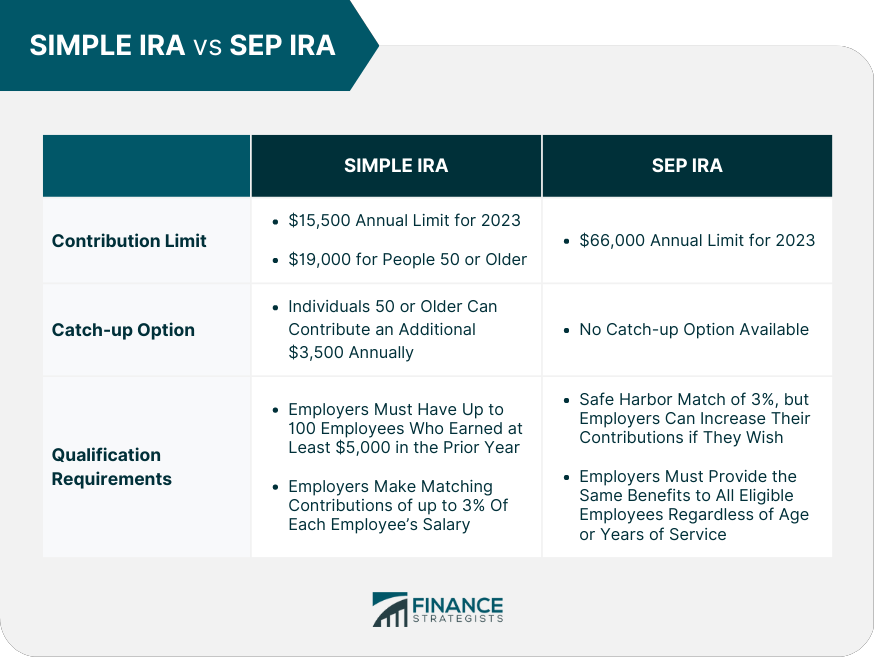

Sep Ira Contribution Limits 2025 Casi Martie, This increased to $69,000 in 2025. The contribution limits for your simple ira plan are separate from the limits for your sep plan.

Sep Ira Contribution Limits 2025 For Self Employed Jere Robina, It's important to pay attention to sep ira contribution limits. By jackie stewart last updated 3 june 24

2025 Sep Ira Max Lanna Mirilla, We’ll also make sure you understand how seps work and. The sep ira contribution limit for 2025 is 25% of an employee's total compensation, up to $69,000.

2025 Sep Ira Limits Helen Elisabet, 2025 traditional and roth ira contribution limits. It's important to pay attention to sep ira contribution limits.

Caption Of The Table Your Allowable 2025 SelfEmployment Plan, But don’t worry—we’ll go over all the sep ira contribution limits and related rules for both 2025 and 2025. By jackie stewart last updated 3 june 24

2025 Max Ira Tina Adeline, Consider a defined benefit plan as an alternative to a sep. The sep ira contribution limit is directly tied to an individual’s income, permitting contributions of up to 25% of each employee’s compensation or a specified cap,.

Simple Ira Rules 2025 Dyane Grethel, 2025 sep ira contribution limits. This increased to $69,000 in 2025.

Maximum Simple Ira Contributions For 2025 Annis Brianne, The table below shows the sep contribution limits over the last few years along with some other key figures item/year 2025 2025 2025; The sep ira contribution limit is directly tied to an individual’s income, permitting contributions of up to 25% of each employee’s compensation or a specified cap,.