Tax Brackets 2025 Oklahoma. Your average tax rate is 10.94% and your marginal tax rate is 22%. Here is the list of tax brackets for single.

Oklahoma state payroll taxes for 2025. In oklahoma, the tax brackets and tax rates vary for single and joint fillers.

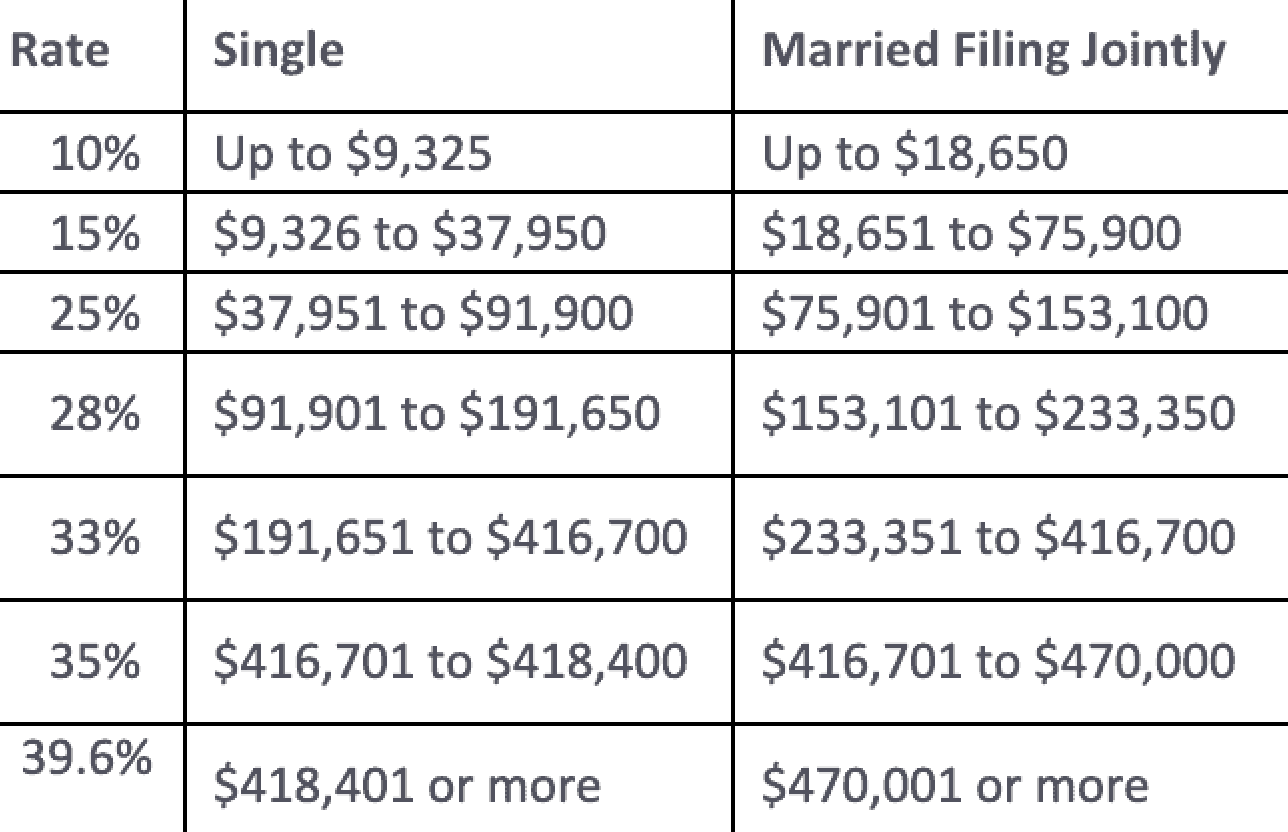

Oklahoma Tax Tables 2025 Tommi Gratiana, As of 2025, there are seven different federal income tax brackets ranging from 10% to 37%.

Tax Calculator 2025 Oklahoma Lesly Myrilla, Five tax takeaways from 2025 state legislative sessions.

Tax Brackets 2025 Explained Dorris Courtnay, According to the oklahoma tax commission, any clothing or footwear under $100 is exempt from taxes.

Tax Brackets For 2025 Taxes Zonda Kerianne, Like the federal income tax, the oklahoma state income tax is progressive, meaning the rate of taxation increases as taxable income increases.

IRS 2025 Tax Brackets, However, the state constitution allows municipalities, defined as cities and boroughs, to assess a local.

Tax Brackets 2025 Vs Candidates Kial Selina, Each state’s tax code is a multifaceted system with many moving parts, and oklahoma is no.

2025 Tax Brackets IRS Makes Inflation Adjustments Modern Wealth, For tax year 2025, oklahoma will impose state income tax rates that range from 0.25% to 4.75%.

New tax brackets for 2025, The 2025 tax rates and thresholds for both the oklahoma state tax tables and federal tax tables are comprehensively integrated into the oklahoma tax calculator for 2025.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, With six marginal tax brackets based upon taxable income, payroll taxes in oklahoma are progressive.